A Potato’s Cycle Through Inflation in South Africa: What is Inflation and How Can You Cope?

In 2022 we saw the highest rate of fuel price increases in history not just in South Africa but globally. An increase in fuel had a considerable knock-on effect on the prices of many goods and services and as a result, the cost of living has increased. How then do individuals and businesses navigate inflation in South Africa?

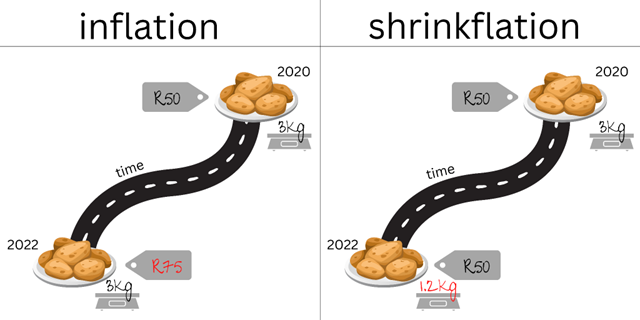

Shrinkflation: a form of inflation

Inflation is a general increase in prices. For instance, if a bag of 3kg potatoes in 2020 costs R50 and two years later the same 3kg bag costs R75, that is inflation. Shrinkflation is the decrease in an item’s size yet the price remains the same. For instance, if a bag of 3kg potatoes in 2020 costs R50 and two years later in 2022 a 1.2 kg bag costs R50, that is an example of shrinkflation.

How Does Inflation Affect South Africans?

Both shrinkflation and inflation are about the pricing and purchasing power (ability to buy) of goods and services. An increase in pricing means your purchasing power decreases and the reverse is true in that a reduction in pricing means your purchasing power increases. Importantly, shrinkflation and inflation are always about a decrease in purchasing power — assuming provided that all other things, e.g. your income, remain the same. This change in purchasing power means that our ability to buy more things decreases. The implications for the individual mean that you have less food in your grocery basket because it now costs more to buy those items.

The implications for businesses and the economy look a little different. If we think of the recent increase in the price of fuel, it has affected many facets of the economy. The increase meant transportation of goods and services increased and to make up for the costs, those goods and services were sold at a higher price.

This scenario has so many moving parts and the reality when it comes to the prices of goods and services is that there are many moving parts. As a consumer, your control over these prices is limited; however, not everything is out of your control. The goal should be to establish some sort of equilibrium, equilibrium being a situation where both the consumer and business are happy and capable of fulfilling their core functions. As humans, we do it naturally, sometimes without realising it. Yet when the spike in prices is really high, reestablishing equilibrium can hurt.

How Can You Deal with the Increase in Pricing (Inflation)?

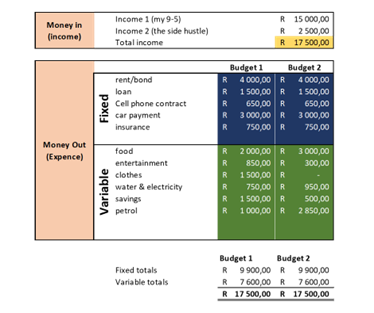

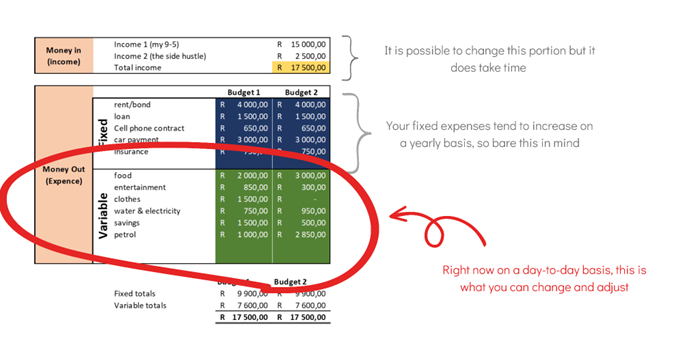

Finding your equilibrium starts with knowing where you are. Find out how much money is coming in and how much is going out. Then you can see where you can make your adjustments. You have fixed expenses and variable expenses. The fixed expenses are exactly the same every month, such as your rent/bond and cellphone contract. Generally, you know this amount from the moment you commit to it. On the other hand, your variable expenses like food or electricity change every month.

When the prices of goods increase but your income is not increasing, your approach is a little different. There are two things you can do: increase your income or decrease your expenses. Doing both is not necessarily easy or feasible; however, they are possible. When it comes to making changes financially at this very moment as an income earner, it is your variable expenses that you can change to adjust to the increases in pricing.

Changing prices have affected everyone, yet we all can do something to adjust to it. Businesses need to become creative and find ways to ethically reduce their cost of production while still supplying goods and services at a price that consumers are willing and able to buy at. The government also plays a huge role in that it can control pricing. A good example is that the price of fuel sold in South Africa is set by the South African government and has been subsidised to alleviate the burden of inflation on consumers.

Individual consumers carry the weight of price increases more heavily than businesses do. Yet humans are resilient and we can adjust and change to meet the demands of our finances. Budgeting and managing one’s finances is critical in navigating inflation and shrinkflation in South Africa.

Budgeting can feel like a pain but what it does is alleviate stress. Not knowing what is going on with your finances will always come back to bite you. There are simple recourses such as 22seven that you can lean on that assist with managing personal finances. There are apps, too, that you can download and most of South Africa’s major banks offer tools on their internet banking apps so lean on that as well if you find yourself in the dark financially.

The starting point is knowing where you are financially. From there you can start managing your spending and saving. Budgeting may feel counter-intuitive to combating inflation. However, it isn’t. It allows you to see where you are and from there you can easily see the points where you can improve. We all need to start somewhere and the journey is worthwhile because it is an investment into your future.